24 min read

Many R's Podcast - S2E2 (Part 1) - BANNED in Singapore.

Mark Smith

:

Updated on December 6, 2023

posted 21 November 2022 updated 2 January 2023

Welcome to Season 2, episode 2 (Part 1) of the Many R’s Podcast highlighting our centrefold Steve G Papermaster. This series is presented by Mark J Smith of DC Partners Solutions, Sydney, Australia.

Chapters:

0:01 - opening music

0:23 - greeting by Mark Smith - about Mark Smith & DCP Solutions

1:13 - about the Many R's Podcast - Season 2 Recap

1:31 - Season 2 Recap - Westpac

1:47 - Season 2 Recap Phillip Crawford, NSW Casino Control Authority

2:06 - Season 2 Recap Garry Steinberg, Reliance Leasing

3:14 - Season 2 Recap Andrew Borrodell Gartrell

4:08 - Season 2 Recap Aqua Law, Ben Horne, Tim Horne

5:00 - Deep dive Steve Papermaster

5:14 - Who is Steve Papermaster

6:40 - Steve Papermaster & Ernst & Young - Entrepreneur of the Year Awards

8:37 - Who is Steve Papermaster continued

9:11 - Steve Papermaster & Arun Kant intro and representations / misrepresentations

10:10 - Who is Steve Papermaster continued including enabler

11:45 - Steve Papermaster's cure for curing

13:35 - Steve Papermaster & Ernst & Young - Entrepreneur of the Year Awards - continued

14:34 - Arun Kant deep dive - intro and representations / misrepresentations

15:50 - Steve Papermaster & Ernst & Young - Entrepreneur of the Year Awards - continued

18:38 - about DCP Solutions interesting work / profile

20:10 - Arun Kant / Leonie Hill Capital Pte Ltd Singapore deep dive - intro and representations / misrepresentations continued

27:35 - who is Arun Kant of Leonie Hill Capital Pte Ltd?

29:06 - introduction to Season 2 Episode 2 - Part 2 - a further deep dive into Arun Kant / Leonie Hill Capital Pte Ltd, need for a forensic review of Nano Global's bank ledgers, Henry Legere, Nano Global's team.

37:53 credits

Transcript

S2E2 - Part 1 Transcript

Rogues Rascals Reviewables Rorts rip-offs receivers real estate agents and much much more

this is the many R’s podcast

season 2 episode 2.

well if you've got any questions give us a call anytime 1300-327123 or visit our website dcpartners.solutions/podcast and go to the bottom right hand corner instant message chat with us using those links in the bottom right hand corner

thanks very much

welcome, well welcome back it's been a long time and it's been a very weird year a very weird year indeed I'm Mark Smith from DC Partners Solutions and for those that are just tuning in we've had lots of lots and lots and lots of new visitors to our website throughout the year and I'll go through some of the numbers my name is Mark Smith I've got an MBA I've got a law degree I'm based here in Sydney and spend a lot of time out in Orange in Country New South Wales I'm a member of the young lawyers although I'm not a solicitor I am a member of The Graduate Management Association of Australia the tax Institute three adult children lots and lots of life experience and we're getting something like seven to eight thousand unique visitors per month so that's about 2 000 a week so it's it's been a very very interesting year there's also been lots of fun and games on the sidelines and so we haven't covered everything that we had hoped to cover this year so let's so what had we hope to cover this year Well we talked at the end of last year in season one episode eight about deep Dives that we were going to Undertake and we haven't really gotten there this year but maybe next year or maybe season two just rolls on into season well let's extended into 2023 it's weird to say but it's been a hell of a year and I'll talk about that another time we were going to have a look at Westpac well some interesting things there we there is a lot on Westpac on on our website now dcpartners.solutions and there was quite a scandal anyway it's quite old news but it's interesting that one of the characters the Philip Crawford has popped up at the casino regulator and is handing out billion dollar fines to the star and the crown this year he's had a huge year Philip girlfriend now I'm not suggesting he was well I'm suggesting he was the lawyer for Westpac that's that's the lot it's he has a an interesting client Gary Steinberg well we've had a number of different Court issues with Gary this year and it's been a busy year for poor old Gaza and Reliance Leasing and and their lawyer formerly my lawyer Mr Tim horn not to be confused with Mr binhorn so Tim and Ben from Ecuador we're probably not going to talk at all about Ben well we might just come to him at the end of this page but Tim has had a busy year he was the lawyer he was my lawyer for about three years or thereabouts and then he turned up working for my opponent so Reliance Leasing and Gary Steinberg so very very interesting and it presents moral and professional dilemmas for lawyers to to then end up working for against their former clients and well watch this space Gregory John Walker 131 NVR and of course his other company MacArthur projects sadly we also talked about his other project in Gosford the Archbold project not been a good year for a Gregory John Walker we're not going to touch on him there's no deep Dives but look maybe later in Season Two Season Two we're a long way behind where we hope to be Andrew bardel gartrell boy Andrew started the year his father died commiserations I don't know whether Andrew has is a beneficiary of his father's estate although Andrew features on this website Andrew I understand is in Australia and we missed Andrew this year we didn't give him any thought well very little anyway he so we may come back and do some deep Dives on Andrew birdell gartrell Adam Tilley well we didn't get to have a think about them Mahoney Law and Ralph talagaru Mo and Kumar now as far as I know moan Kumar is still in tihar prison in Delhi in India and as far as I know Ralph paligaru is still his power of attorney and Mahony Law is instructed I guess for Mohan Kumar so don't know haven't been checking had other things on the plate but let's let's come back to them later on in season two aqualor now I will just say Ben and Tim are brothers and Ben's a lovely guy I truly truly mean that I I say that tongue-in-cheek about some other people Ben's a nice guy but I have renewed respect for Ben he we might get into some of the circumstances he's he's had to be Tim's brother I think he's the older brother but I might be wrong um

I think Ben deserves the a medal for paint Tim's brother this year so they don't talk to each other from what I understand and I just wish Ben well if we don't get to if we don't get to

at the end of this year if we don't get to wish Ben a happy Christmas then happy Christmas to Ben so without any further Ado we're now going to dive in and talk about our friend Steve papermaster Steve G papermaster of Nano Global and our current current centrefold um

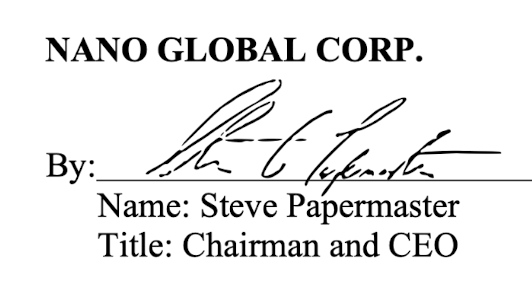

so who is Steves papermaster you might ask well and why why some lunatic blogger in Sydney blogging about this guy well this guy is a prize-winning confidence man shall we say steve papermaster you used to work at the White House apparently and this is an extract taken we're going to say well who is steve well this is from a page that no longer exists it was on Ernst & Young's website steve is the I love it when people use fancy titles like chairman or a CEO I mean wait until you see this wait until you see about this company it's steve is someone that either is dreadfully dreadfully unlucky over and over or

will you make up your mind this is a picture of the lovely steve Papermaster he's married to a person called Gail Papermaster apparently apparently a world-class lawyer from Austin Texas and steve managed to um

separate millions and millions of dollars from very very Discerning investors and he also managed to get himself kicked off Ernst & Young's website since we've been blogging so that's kind of interesting and if for those that think who's this idiot blogging over in Sydney well apparently some people do watch this blog so okay so who is he he he was very heavily tied up with Ernst & Young not a partner but he was a Founder I think the term is of the Ernst & Young entrepreneur of the Year award and this is a very very prestigious promotion but Ernst and Young undertake every single year they put millions and millions of dollars into this every year and partners and branches if that's the term around the world all get very heavily involved in promoting this and they all get together in Monaco most years now it's been a bit different last couple of years because of covid but Stevie was it was a judge and I understand he was a founder of this of this Ernst & Young entrepreneur of the Year program so he himself was on the (judging panel) he was Judge … those that can't do teach and well anyway he was he was he's been a judge for many years and interestingly if this is correct he was the world entrepreneur of the year 2001 judge now at the same time he was buying Super Bowl ads and millions and millions of dollars and buying hundreds of bottles of wine and blowing up a company called agillion which which lost an agillion dollars for its investors and anyway Steve okay apart from working at the White House apparently now I don't know if he actually worked AT the White House but they say he was an advisor to a direct advisor to President George W bush now I'm going to show you his bank statements here and you'll see all the people that he pays for advice? and it certainly makes you wonder whether he's an expert and if he's if he is such an expert they might as he need all of this advice? and then well in the end you know companies that go kaput and lose the sorts of money that I'm going to show you on on their bank statements it will have you wondering whether this guy well Ernst & Young no longer associated with him and I'll show you an email from from their lead partner who looks after this entrepreneur of the Year award and poor Steve so now Steve claimed I don't know if he sells snake oil or cures to covid but apparently he he well if you if if you don't know season to episode 1.5 there's an interview with Steve and if you're going to work out what's what it's about Steve claimed to have a treatment for covid and well in a minute I'm going to show you a video of Steve's where he claims to have a cure for kills oh my God this is one heck of a good guy so but when when we're done with talking about who Steve is well then we'll have a look at some of his other enablers and one of them is a guy called Areal Kant oh no it's not Areal Kant Arun Arun Kant [ __ ] sorry Arun as most unfortunate name Arun Kant and Arun

was one of Steve's enable us if we can put it that way we'll have a good look at what a rune not Areal Arun had to say about steve and his companies and how disruptive they are and what good shape it is and you will when you have a look we'll line up some statements that Arun made with some bank statements and well some representations made by Arun and Steve about how good these guys are and how strong their company is are at Nano Capital which collapsed about five or ten minutes after they Bank the money and it will it will leave you scratching and you'll you'll certainly at the end you'll conclude that well Steve is no expert and I think he should you know really consider retirement so who is he he claims to be all these things an entrepreneur and investor a public policy expert a global speaker and noted author and if you want to know a little bit more I encourage you to go to season 2 episode 1.5 and watch that and we talk about Steve or you can just Google steve Steve papermaster two words Steve papermaster and go and visit www.dcpartners.solutions web page

all right so who is Steve papermaster who is Steve papermaster well it just so happens we have a website called www.dcpartners.solutions tag anyway there's a link I'll just pop a link here you can pause this and write this down

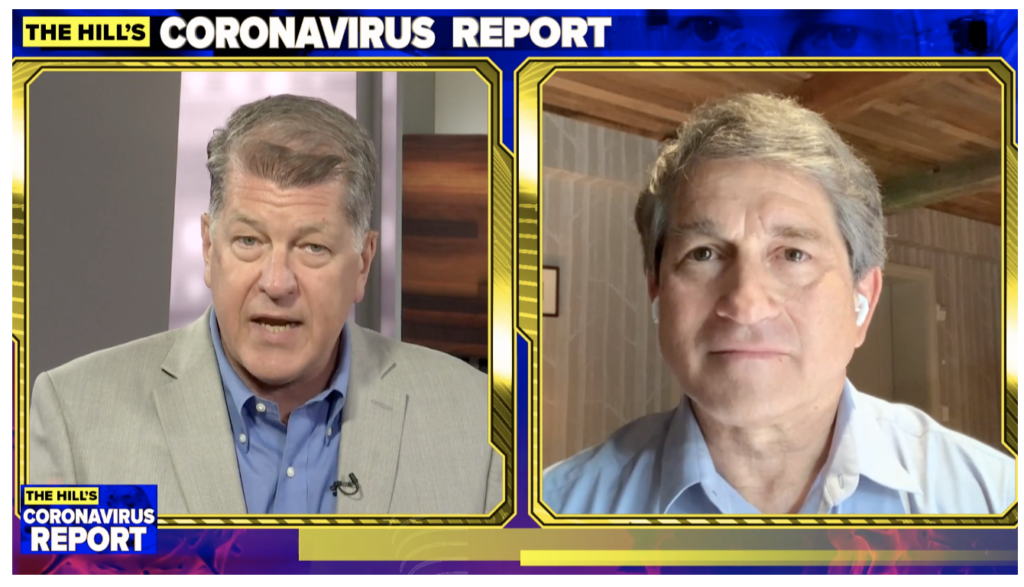

it's a very good question and well we're we're saying Steve is enabled Steve is a person I've questionable business acumen who happens to be enabled by a number of people and that's that's a very interesting topic we have a page also on his enablers and I'll just pop up a link here on his enablers he's like The Great Oz and you know supported by a whole bunch of people so here's the link to his enablers each one of these people we say enabled Steve to run these various different schemes for years and years and years and raise millions millions of dollars and I'm going to show you at the end of the day how successful this particular company that claimed to have a covid cure was during covid and well I'll let the I'll let Steve's own documents do the talking the cure for cures wow that sounds pretty good well we're now just going to go and have a look at a short YouTube video I'm going to speed it up a little bit because it goes for a couple of minutes but Steve promises a cure for curing the mind boggles have a look at this please and then we'll come back we'll take you to something even more bizarre Healthcare is sick, well we can cure its the most important thing that any of us have is our health right now the rate of infection is skyrocketing on a global basis cancers although there's been great advancements right now the failure rate of new drugs is over 95% in clinical trials just like we saw a transformation with the internet into e-commerce and into content we will see a vastly greater transformation in the connectivity of life we are at Nano vision building a platform that we often call the cure for curing the nanotechnology and auto scale data is data of life we are rapidly advancing our cure development platform working with several of the most sophisticated biotech companies in the world the internet of nano things is bigger than anything that we've seen before of all things in our life health is the most important thing in our life and we have made despite tremendous advancements we've made the least progress in fundamentally changing how we relate to our health on a day-to-day basis you can locate your Netflix account in a second pull up Uber in a second understand what my my Amazon or other accounts are but the second I reach for everything about my health I have no where to go. updates platform to drive Paradigm shifts in healthcare that means a paradigm shift it means changing everything of the way we think of care and curing let's take the case in point 1960 5% of GDP in the United States is known Healthcare 2019 22.5% … almost $4 trillion dollars a year, break that down how much of that is spent in advancing health and cures less than 10% we are now at a point where though we have all the components that we need to build and deliver a new kind of platform for charting your path forward of not only your health as it projects out but where you'd like it to be it's time not only do we need it not only should we demand it not only should we expect it but we can do this

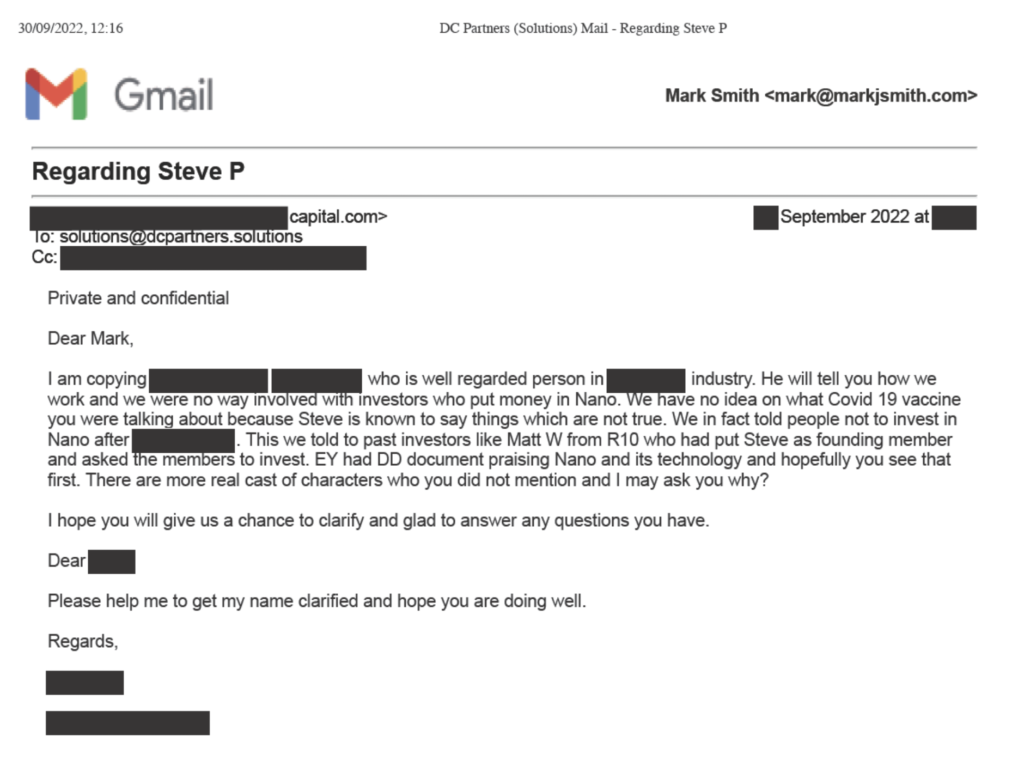

Okay so we've touched on enablers and we touched who I've said did include Ernst & Young and we've talked about who is Steve papermaster and we've talked about his cure for cures and our cures for curing or something whatever but even on top of that there's another spin that Ernst and Young I gave this guy an incredible platform Ernst & Young and they've since kicked him off the platform and we're just going to have a quick look at an email we wrote and a couple of things that came out and there's this very very mysterious Ernst & Young alleged due diligence document that no one seems to have and no one seems to have read or obtained or we'll have a look at the bank statements as well and it casts huge doubt about this and I will then give you an update on what where Ernst & Young are now which is even more Curious so a we put this blog up several months ago and I got a message from out of the blue from someone. now so we got this email a little while ago saying Steve is known to say things which are untrue so that was a bit of a worry I got that and but you know we published this on the 30th of September 2022, but we didn't actually publish it all. well I'm just wondering if you'd look if you'd like to see this a little bit more maybe I'll show you in a little bit but anyway we're talking it talks about here this thing called the Ernst & Young instant young had due diligence DD document praising Nano and its technology and hopefully you see that and anyway I'll tell you about this here in a moment but let's jump back to so remember this I'll tell you who actually wrote this document and that cites this and this particular person said we in fact told people not to invest so this is kind of a very interesting position that this that the writer of this document is placing on the record he's sent this and I have every reason it's a very very prestigious firm and a very prestigious person within a very prestigious firm who goes on the record well he sends this as private and confidential but I've published This months ago and this person asked to comment and he asked to clarify his name and well we'll come back to this this email is is quite key but let's go now and have a look at some correspondence that I did write to Ernst & Young.

and you'll see here this is what a web search typing Steve papermaster used to bring up and it had a Steve Papermaster's Wikipedia page and then the second link was an article to the linking to Steve's ernst & young Global World entrepreneur of the Year page now that page we'll have a look at it now but I'm telling you it's gone and why is it gone well I wrote this little letter to a just a number of professionals at working at Ernst & Young and I'll maybe I'll put up a copy of this letter anyway it asks the question if Steve is still viewed as a person embodying the ethos of the Ernst & Young entrepreneur of the year Awards and any thoughts of values and business Acumen considering how many companies poor state papermaster has been has resided over which have ended up kaput and I've attached the a redacted email I received from someone who's one of the largest and most prestigious fund manager in the world critical events in Young and the due diligence package that he prepared and anyway he says he told that that writer according to our web page he says that

this writer says that he told investors NOT to invest

now I'll tell you who he is in a minute and whether he's a whether he is a person that should have been telling people not to invest and whether that was the case whether he did actually tell people not to invest or he says he didn't but you be the judge. so so I send this and this is the list of people that I send it to just just a few anyway they're all at Ernst and Young in Japan India Indonesia Italy Russia Canada United States and so on but particularly went to a lady called Stasia Mitchell stasia.mitchell diy.com and I promptly received a reply back copied to someone in Papermasters own Branch Ryan Burke who I think was in Dallas or maybe Austin of Ernst & Young hi Mark thank you for your caution and inquiry we've quietly distanced and dissolved our relationship with Steve and kindly advise you to do the same oh my God so this is a distancing they're saying he's got leprosy don't touch him additionally additionally additionally our Global PR and social media team will not promote or allow us to be connected in any way in any way copying in reinberg for comment and coaching thank you Stasia Mitchell. wow so poor poor Stevens so Paul Steven there has lost his endorsement so to speak from ernst & young

so it's very interesting a lunatic blogger from Western Sydney or Orange gets to ride to 100 and something partners of Ernst & Young I can't tell you the names of the investors … I'm just a but I'm telling you these are very very significant very significant business people and this might go to show the type of interesting work that we do at DC partner Solutions and we

our clientele is very sophisticated we're able to talk to the heads of Ernst & Young we're able to talk to the heads of large Investment Management firms. the particular investors involved what I would call gigantic without exaggeration they are whales you'd call it these people whales as investors and we're now talking about steve papermaster someone that worked at the White House and this is the type of interesting work that we do so if you've got a problem like of any kind of any kind sophisticated complex yeah that's us. we're now going to dissect this even further even further well well so Ernst & Young so there's a few questions here you can see and Ernst & Young have made it clear that they don't like Steve papermaster anymore

so the next group of people we turn to are named Arun Kant of leonie Hill Capital private limited Singapore and well we'll start with them and these investors and Steve papermaster. so I am engaged by as I said a very sophisticated whale investor very very sophisticated and it would be hard to imagine a more sophisticated investor.

very decent people very very trusting people

very smart very shrewd very well resourced but also decent you know trusting decent whole thing. so we're going to have a quick look at this Arun Kant and I'm not confusing Arun of any wrongdoing I'm just questioning some of his wisdom in some of the statements and some of the representations that were made and I'm pointing out and his role and some inconsistencies so let's go now to this particular let's go to this particular email and we haven't actually said it who it was but we say a world a world renowned funds manager and provider of capital and previous papermaster enabler name and ID protected and he was one of this guy's Papermasters most massive investors and backers well he wrote and there's a redacted copy of his email. he wrote Steve is not Steve is known to say things which are not true.

which is an interesting thing to say considering the role this man Arun Kant had as lead investor in Steve's group so we're going to have a look at this redacted version and then I'll show you the unredacted version and there's a few things here that don't quite make sense to me. now I've only got an MBA I've only done a law degree I've only been around for 30 years but if you can figure it out let me know …. I'm copying blah blah now this other bloke blah blah is not my client but he's known to my whale. I'm copying this to blah blah who's well who is well-regarded person in blah blah industry. he will tell you how we work and we are and we were in no way involved now please have a look at this we think Arun Kant and leonie Hill capital

may have misrepresented some things. they will tell us how you work we were in no way involved with investors who put money into Nano okay we were in no way involved we have no idea on what covid-19 vaccine you're talking about because Steve is known to say things which are not true I'll show you the unredacted version I I'll still it's pardon me I'll show you a partly redacted version because they still have some private bits and for the sake of privacy we're going to still redact this name this blah blah I'm copying this to blah blah we are in fact people we in fact told people NOT to invest in Nano. so that's a very interesting thing

they told Leonie Hill Capital told not only told my Whales that they should invest. they welcome them they told them that they were very committed to and you'll see the exact words they told the whale that they were very committed to Nano and investing themselves and not only that Arun Kant agreed assigned documents to agreeing to be a director of Papermasters company and it would appear performed duties and gave advice as a director would here under Australian law now the company Nano Global is not an Australian company and I'm not giving anyone advice on U.S corporations law but under an Australian you know Australian jurisdiction the things that Arun Kant did would expose Arun as to the liability that a director would have we're going to have a look at these bank statements and we're going to test some of the statements that Arun Kant has made to our whale and see how appropriate they are. there's some other things that we're going to have a look at that don't quite make sense about Arun Kant. Arun Kant happens to be the CEO of Leonie Hill capital this we're told to past investors like Matt W from r10 now I don't know who Matt W is who put Steve as founding member and also asked to invest. Ernst & Young had DD document praising Nano and it's a technology and hopefully you see that first. no. we're going to have a look at the bank statements and the bank statements do not show one single dollar paid to Ernst & Young so it's it's going to be very interesting to see Howers and young produced due diligence documents

yet there's no record on the bank statement and then Arun goes on there are more real cast of characters who you did not mention well we're going to be mentioning them in this podcast and we're going to be tagging them and we want to hear from people that know these people I hope you give us a chance to clarify and glad to answer any questions you have. well Arun has gone a little less glad to answer questions and we've given Arun the chance to reply on the record. Arun hasn't taken that up.

so here is the actual email you can see it's from Arun Kant at leonie Hill Capital Arun can't is and was the CEO of leonie Hill capital: dear Mark I'm copying blah blah from blah blah who is well regarded yeah you know Fred nerks from bill bloggs proprietary Limited this is another person I would call a whale who is well regarded in Australian industry he did tell us that he worked but they were in no way involved with investors that's the only Hill capital we have no idea about the vaccine we in fact told people NOT to invest

Ernst & Young DD document. now I've shown you already Ernst & Young have disowned Steve papermaster and they've warned others not to deal with him. so that's not good that is not good not good for Steve

now around the same time Nano was giving out documents saying that they've got new valuations there Leonie Hill Capital co-leads. co-leads so it's very interesting that as co-lead investors leonie Hill say Arun Kant who's the CEO of leonie Hill Capital say we in fact told people not to invest in Nano after after our due diligence failed.

after our due diligence failed. this we told to pass investors like Matt W we put Steve as founding member Ernst & Young had DD document praising Nano and its technology and hopefully you see that first there are there are more real character cast of characters who Arun I don't think speaks English as his first language there are more real cast of characters who you do not mention and may ask why so again we're going to discuss these bank statements this comes from Arun Kant

we're just going to go and have a look at Arun's profile

well Arun's page

this is a this is an archive version and Arun was there and Arun was listed under about us, team. a current look at about us team shows that page is not there so I don't know if Arun Kant is suddenly left the building but a live version of leoniehillcapital.com shows that Arun Kant is not there not there. gone. so that particular page is not found

very interesting and that's the chief executive officer and chief risk and compliance officer for leonie Hill capital and this particular document shows Leone Hill capital now we do have a page on Arun Kant. and we have had this page up since August and we have extended to Arun. The right of reply. well we've given it's not a right of reply but we've offered to respect him as if there was a writer replying we do have some email and some phone contacts and mobile phone numbers for Arun we've certainly reached out extensively to Arun he hasn't lately taken my call so we'll include that anyone that knows Arun knows papermaster and knows of this matter we're quite Keen to hear from anyone about this matter and there's a spot where you can leave a reply on this website www.dcpartners.solutions/podcast - or you can complete a form and attach files and send us tip-offs we'd love to hear from you thank you. well I've had a change of mind I was going to run this episode and go through everything that it actually gets very technical I've had a little change of mind that I actually think that this is slightly too Technical and I'm going to upload this video I'm going to stop the the podcast now and I'm going to update upload this video as part one of season 2 episode 2

and I just want to take my time there's a there's quite a lot of transactions there's a huge number of people there's a huge number of people now we've got the bank statements as I said we've got internal records of Nano Global this company that went down the toilet and um

that went down the toilet and I can tell you that something in the year of 2019 somewhere in the order of $20m dollars U.S so in Australian terms that's pretty much $30m so it's not a small amount of money and why is some idiot from Western Sydney lunatic blogger blogging about this well this lunatic sorry this this so-called Guru Mr papermaster he came to Australia and he got money like very substantial money out of several whiles one of them is my client and several when I say whilst I'm saying the people the very clever people they're very smart people and

their I guess they're feeling like victims and um

I guess they're feeling like victims and there is a paper trail and I'm certainly not accusing Arun of Arun Kant or Henry Legere in fact I think Henry Legere is who we're going to look at I think he comes through this in a very very good shape but he what's going to be the incoming Nano Global president and chief medical officer and I bet you he's thanking him he's his lucky stars he's not he and I exchanged documents and we corresponded and I'm going to publish that I think he's a good guy this guy. Henry Legere has met Arun Kant or if not Arun can't someone very very high up in Leoni Hill Capital and the forensic pulling apart of this is quite Technical and to do justice I plan to just split this episode into 2. and we will go through this step by step line by line of this bank statement and you'll have a look now I so I say we're going to look at this bank statement of The Ledger we're also going to look at the team Nano Global team and you'll see the team and who gets money and how much money how much of this $20m USD bucks got a raise I can I'll skip to the end I'll tell you it's all gone so we can look at I'm relying on this document I don't think it lies I've got other documents of Nano Global apparently written by Steve himself and so we're going to look at that team and and how they got that $20m bucks

essentially for a healthcare product The Cure of cures and I'll show you the excuses you've seen in episode 1.5 this video of Steve's where he talks about a treatment for covid and other pandemics like future ones and yet come early 2020 Steve's now blaming the pandemic and saying oh well that's the reason you've lost your money after $20m dollars has been paid. certainly not exclusively to Steve but it's gone and quite a lot of it went to Steve and he's if the well management team his management team it's you pay peanuts and you get monkeys well this is a a case where $20m US dollars so the equivalent say $30m AUD has within a very short period of time evaporated and evaporated yes that's a very nice way to put it vanished evaporated been consumed however you want to put it so what we do know is Ernst & Young wants nothing to do with Steve papermaster hey disown him. Arun Kant

well he decided not to invest. he wrote to my whale and told them they were very committed I welcome aboard welcome aboard yeah we'll take your money and Nano was in good shape and very disruptive so at that exact time at the exact time that Arun Kant was writing this to my whale I'll show you the pain statement and the bank balance and you be the judge of just how good a shape Nano Global was in and for Arun Kant to be writing that he was very committed and it was in good shape oh and very disruptive or highly disruptive in other words Nano was changing entire sectors of the economy. I'll show you the I'll say the sales the revenue the income that's coming in so the entire bank state.ments the they're not the actual statements but they're The Ledger and Bank Ledger for 3 Nano global bank accounts which has all the sales and you can be the judge of how disruptive it is so what I'm looking to find is whether Arun Kant or Steve papermaster or Henry Legere or anyone else has participated in some course of action

some offence, I'm not saying it did but I'm looking at this evidence and you can look at it and make up your own mind so we're going to just dissect that further today's Monday the 14th of November 2022. I've got some personal projects on I'm going on a research trip how's that sound and I may well come back with even more information so that's another reason just to slow things down I will prepare part 2 of episode season 2 episode 2 and I'll upload that when I can. there may be there may be a part 3 maybe. so I hope you find this interesting if you've found this interesting so part one was probably a little bit more light-hearted but part 2. I'm telling you it will be forensic it will be factual it will go through this ledger line by line. and you'll be able to consider the competence of Arun Kant and leonie Hill Capital whether there was any misrepresentations and really whether, they're a good fit to be listened to as advisors or whether you should take things that they say with a grain of salt. and it was Arun Kant after all who said that Steve papermaster was known to say things that were not true. you can consider whether that statement applies to Arun. so Arun if you're listening and you want to reply to any of the things that we've said so far I'll happily give you the opportunity to reply and put your side of the story. now In fairness I did correspond with Arun between the end of September and now and today's the 14th of November. Arun claimed to be in Switzerland. he claimed to have a elderly mother who he's attending to. he also claimed to be sick so maybe he needs a nano cure? and he claimed to have had covid, and have other illnesses. so I received a reply from him on Friday the 11th - thats 11-11. I love the number 11 11. Arun claimed to be out of the office and he would need time to reply. well Arun's been out of the office, it would seem, out of the Singapore office for months. so he hasn't responded to me saying who was filling his shoes?

I did message him, Arun. if you want to reply or someone else from Leonie Hill Capital wishes to reply and wishes to set the record straight? and if anyone has the Ernst & Young due diligence report? if it even exists? by all means send it to me mark@markjsmith.com … thats mark@markjsmith.com

or you can go to our website www.dcpartners.solutions/podcast - I did

and there's a form there on that page you can just upload it send us a tip off. send us any tip-offs you like. so this blog does get looked at it gets watched it gets watched by some very surprising people, so not necessarily conspiracy theorists or lunatics it does get watched from time to time by some serious people. so I invite you to tune in to season 2 episode 2

part 2 of the many R's podcast and we'll continue the story. thanks for watching [Music] thank you

If you’ve got any questions then give us a call 1300 32713 or go to our bottom right hand corner instant message us or instant chat with us on www.dcpartners.solutions

[hubspot type="form" portal="4799618" id="ed142ca3-c9d0-4027-bd18-c14858ac51b5"]

Transcript

coming soon, 21/11/2022

#whoisstevepapermaster

If you’ve got any questions then give us a call 1300 32713 or go to our bottom right hand corner instant message us or instant chat with us on www.dcpartners.solutions

[hubspot type=form portal=4799618 id=ed142ca3-c9d0-4027-bd18-c14858ac51b5]

Other Snowgums Blogs

The Controversial Story of Steve Papermaster: Technology Entrepreneur or Fraudster?

Many R's Podcast - S2E2 (Part 2) - the full uncut episode (censored on Youtube)

The Truth About Steve Papermaster: Confessions from a Former Enabler

Uncovering Financial Irregularities: The Shocking Revelations in Many R's Podcast S2E2.5

Documents referred to in S2E2.5