6 min read

Acts of Bankruptcy - s40(1)(c) Bankruptcy Act 1966.

Mark Smith

:

19 April 2021 6:26:22 PM

Mark Smith

:

19 April 2021 6:26:22 PM

How does aBankruptcy Notices under the Bankruptcy Act 1966 work?

BANKRUPTCY ACT 1966 - SECT 40(1)(b)

(1) A debtor commits an act of bankruptcy in each of the following cases: ....

(c) if, with intent to defeat or delay his or her creditors:

(i) he or she departs or remains out of Australia;

(ii) he or she departs from his or her dwelling-house or usual place of business;

(iii) he or she otherwise absents himself or herself; or

(iv) he or she begins to keep house;

Source: http://classic.austlii.edu.au/au/legis/cth/consol_act/ba1966142/s40.html

Need finance?

More info on Bankruptcy?

Whatis aBankruptcy Notices under the Bankruptcy Act 1966? The Act definesBankruptcy Notices as follows:

Do you have a problem with aBankruptcy Notices? Have you been served aBankruptcy Notices? Does someone owe you money and you'd like to issue aBankruptcy Notices?

Any questions about Bankruptcy Notices?Live chat with us in the bottom right corner or call us on 1300-327123 till late, or alternatively complete the form below and we'll reply to you promptly.

Watch our video tutorial, live chat with us in the bottom right corner or call us on 1300-327123 till late.

We offer a free first appointment to anyone who is in financial trouble and can assist and advise on anyBankruptcy Notices or a related matter. To book your free appointment - click here.

To learn more about Mark Smith, his training and expertise - click here to go to his profile page

Follow Mark on Twitter: https://twitter.com/mrmarkjsmith

Transcript

well, welcome back to business asset protection where today we're having a look at the bankruptcy act. this is part four of our series today we're looking at section 40 (1) (C) and different ways that a person might try to defeat or delay his or her creditors so come join us okay well here we are in section 40 (1)(C) and we're looking at a a debtor commits an act of bankruptcy in each of the following: so they're all equal okay so if if someone gives you a bankruptcy notice for a hundred billion dollars and you don't pay it well that that is equal to one act of bankruptcy section 40(1)(C) a debtor commits an act of bankruptcy and each in each of the following cases we'll see as if with intent to defeat or delay his or her creditors well let's have a look at this very closely so if , if so that's the question if if with intent to defeat or delay his or her creditors okay so let's have a really close look at this that's section 40(1)(c) if we intend to delay to defeat to defeat which is final or to delay which just means it can only be temporary only has to be slight um his or her creditors in brackets one he or she departs or remains from australia so if you've departed um well that may be - that may be an event bankruptcy now it doesn't it doesn't automatically follow but there are some instances so you do you depart australia or you remain out of australia and and it comes down to - with intent to delay - or defeat his or her creditors. so again it's not automatic um two he or she departs from his or her dwelling or usual house OR place of business so we're gonna maybe actually have a quick look at some of this actual case law and we'll see what it says. 3 he or she otherwise have since himself or herself so that can be you know from australia it could be from you know bondi if that's where you um depart and you know you just go missing or number four if he or she begins or begins begins to keep house. again it doesn't have to be permanent but that in itself just the beginning to keep house can can if with intent to defeat or delay his or her creditors he or she departs or remains out of australia he or she departs from his or her her dwelling house or usual place of business or so he or she departs his or her dwelling OR usual place of business so in other words you do a runner. all right well i'm just going to refer a little bit to this book that i'm reading and i think it's really it's quite complex it's a little bit technical but i think if you'll allow me to just um refer to this book i think you'll get a little bit out of it um what is it what does it mean and what happens in these circumstances if one of these four tests is is present? that they departed or remain out of australia? departed from his or her home or usual place of business? as absenting himself or herself? or beginning to keep house that is to remain in one's house now this is what keeping house means it means to remain in one's house and refusing entry to others to serve a process so just that in itself could could easily be enough it's not guaranteed you've got the covid virus and you've been told to quarantine that that would be a perfect excuse? if you've got cold or flu-like symptoms that too might be a reason temporarily so to keep house the onus is on yes so the creditor the person that's trying to bankrupt um is has the owners to establish that the debtor's intent is to delay or defeat okay so um it does not necessarily have to be the soul intent if it's if it's like a collateral attempt intent that that may well be enough um this can be proved directly through the use of statements so um for instance ralph wants to come back he's choosing to be way you know these these inferences that you can be that can be drawn um use of statements by the debtor or indirectly or indirectly thanks john. um by inference by pro by proving the existence of circumstances which must necessarily cause delay. and which the detour must be presumed to have foreseen or intended to be to be or intended as a necessary result of what he or she was doing. so we could talk through some examples of this defeating or delaying a creditor need not be the debtor's sole intent in leaving australia or remaining out of australia. now these these cases were pre-covid. so again there's probably some argument to say well i'm remaining out of australia because it's impossible to get back or i'd have to do two weeks quarantine like there may be some this there's some grey here so um possibly so it need not be the need not be the sole intent as long as it's an intent it's not enough to simply show that the letters the debtor's conduct has caused delay it has to be intent intention of delaying or defeating.

so it's it's a bit technical. i if you're if you're either one of in one of these two situations you're the debtor and you'd like you know to talk through some of the options, we've got a pre-insolvency um we've got a pre-insolvency division / work and we can do this same work for the creditor so we can talk through and give you some advice on pre-insolvency issues um with quite a bit of precision um these things can be can be uh the absence is they can be an ongoing event of uh bankruptcy so uh it need not uh it could have started ten years ago um if if a person's uh remaining out of australia because they know the moment they step back in the country uh something's gonna happen well that in itself may be an event so there can be an ongoing or uh there's a continuation um these are continuing acts of bankruptcy so we're going to look at some of the other bits um of the act uh gradually throughout the series um there's a time element um in in many of these so these can be an ongoing act uh and if you want to have a read of something case law i can make contact with me use our chat tools in dc partners dot solutions bottom right hand corner um of your screen uh there's a chat tool so join us there um yeah so there is some case law uh if you want some you know general advice um now if you've got someone that's in this position where uh you know they're keeping house uh they are absent from australia uh they're remaining outside of australia uh all these kinds of issues uh they've done a runner from their usual house um they're not telling you where they are they're not answering the phone they are answering the phone that they're not they won't tell you they want some of these uh actually.

matthew taunton there you go um uh refused to give us uh this is a guy we're going to um mention and uh he's he's uh one of our villains. so you'll you will find out uh he's not there yet but uh he's going onto our blog i promise you i promise you he's going there so look uh these are some of the cases. um uh the technical as i said uh you want to talk through some of the different details give us a call 1300 327123 um if you're in one of these positions and uh you need money uh but you know maybe you've got a temporary problem well we might still be able to help you 1300-327123 uh we've got uh tax debt um type uh facilities um you know if you've got a tax problem um and maybe you're in that position where you've got the financial difficulty we we possibly can help you uh on either side of the fence uh the debtor site or the creditor site so give us a call 1-300-327-123 got any questions uh you can chat with us anytime uh www.dcpartners.solutions bottom right hand corner user check tools thanks very much

Acts of Bankruptcy - s40(1)(a) Bankruptcy Act 1966.

Acts of Bankruptcy - s40(1)(g) Bankruptcy Notices

Acts of Bankruptcy - s40(1)(d-h) Bankruptcy Act 1966.

Acts of Bankruptcy - s41 Bankruptcy Notices

Acts of Bankruptcy - s40(1)(ha) to s40(8) Bankruptcy Act 1966.

Read More

Read More

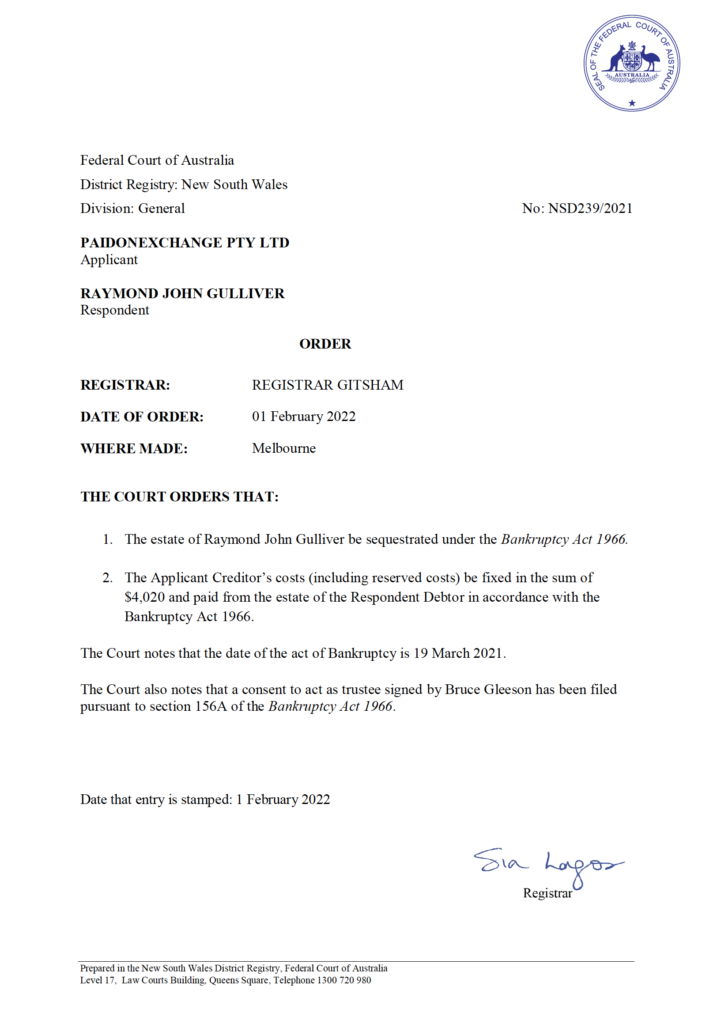

Raymond J Gulliver (in bankruptcy) / Jagbo Pty Ltd (wound up)