Fiona Hall (packing her bags) - profile

Current projects

Past projects

Blog

Case note

Assignment of chose in action

Assignment of debt

5R's

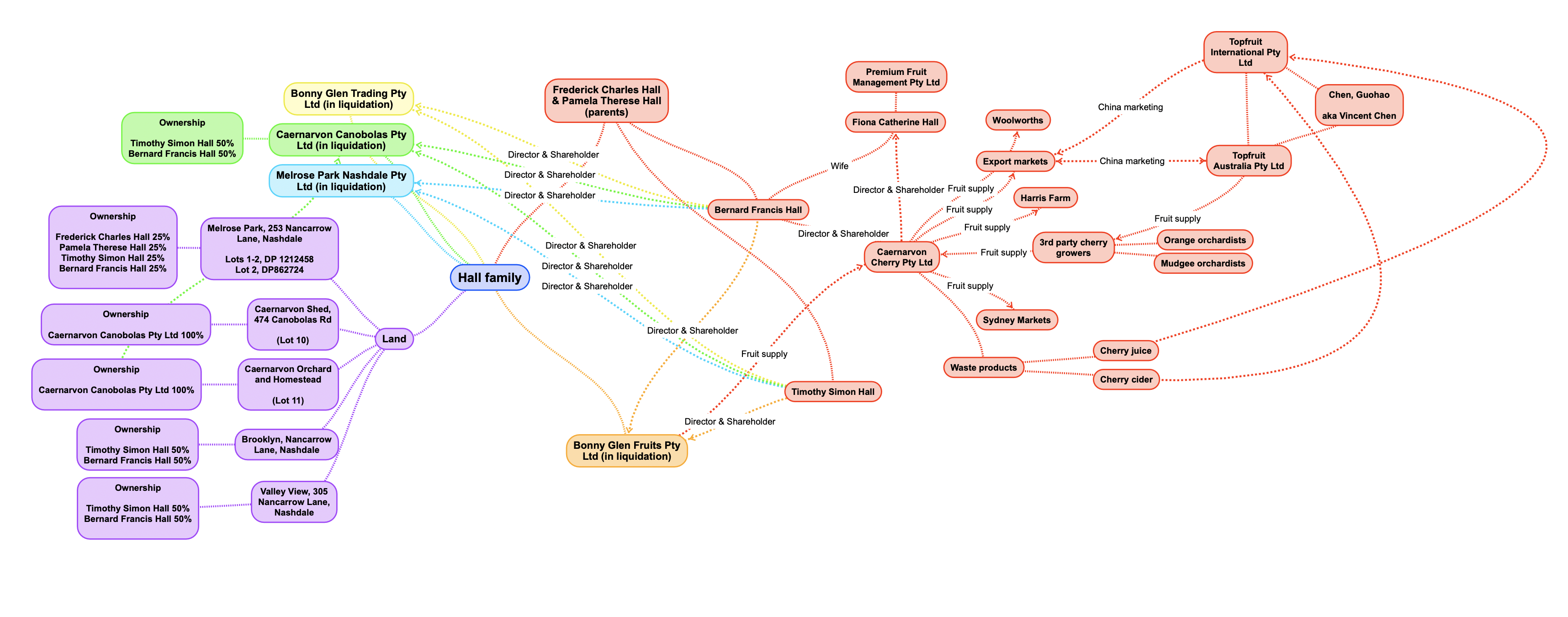

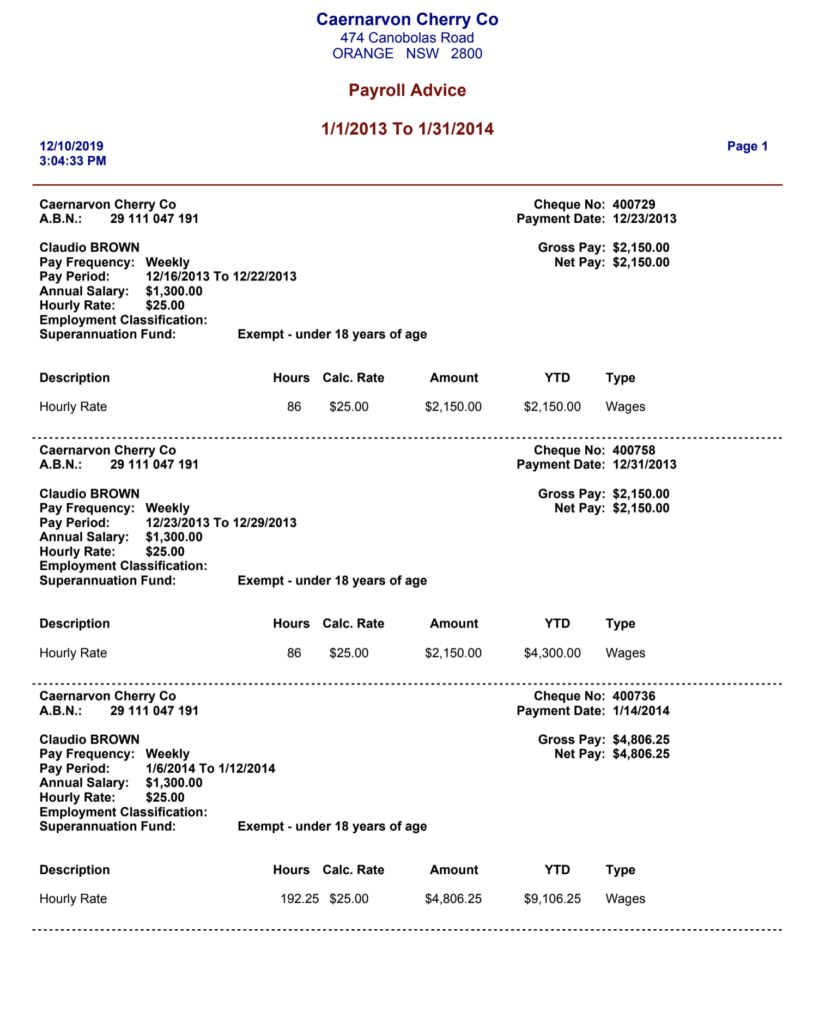

Defendant profile

books and records

Andrew Gartrell

Angela Gartrell

Caernarvon Cherry

podcasts

Video

Defendant profiles

Wage Theft

Corporate insolvency

Nuffield Australia

Class Action

legal concepts

Hall family

Liquidation

director's duties

debt

DCPLH projects

Bonny Glen (in liquidation)

Homeward Bound Holdings

AB Gartrell Philippines

Corporate villains

AB Gartrell

Business Blog

Biteriot

Fiona Hall

Fruit Growing

Nuffield Scholarship

Cheryl Adams

Business Finance Blog

Biteriot Operations